Transaction capability

Transaction interface

Type

Interface

Payment identity

Use Case example

KYC condition

Payment Identity and descriptor in transaction and payment page

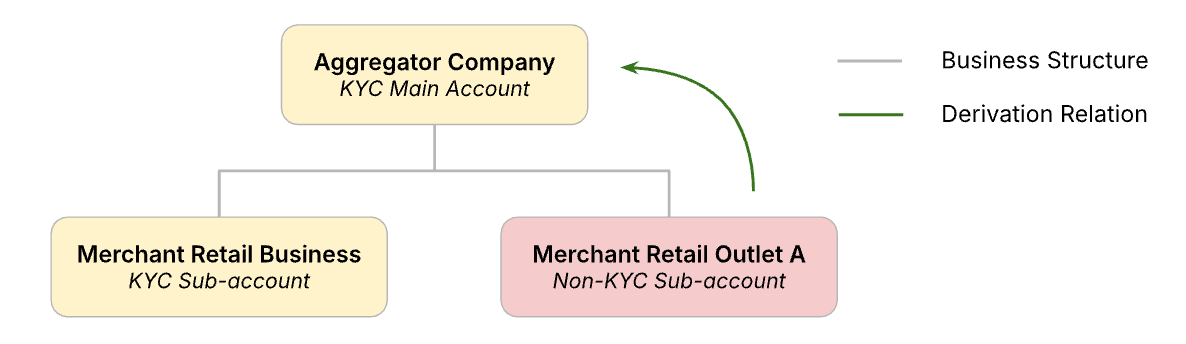

Derived Payment Identity

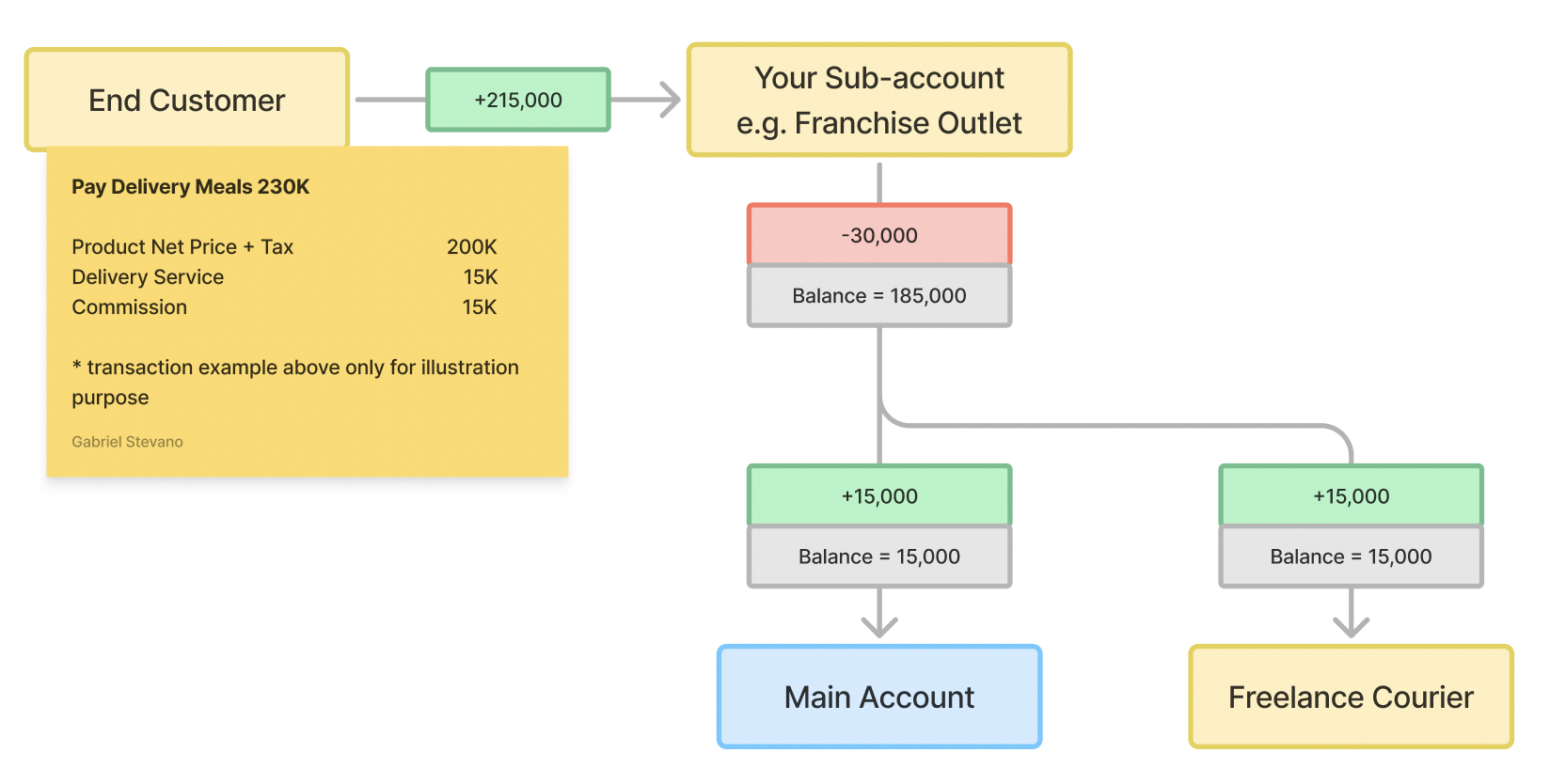

Split and Route Payment